Click here for Official Results

Municipal General, Municipal Referendum, & RSU #14 Budget Validation Election. Your vote matters!

Raymond Revaluation is Underway

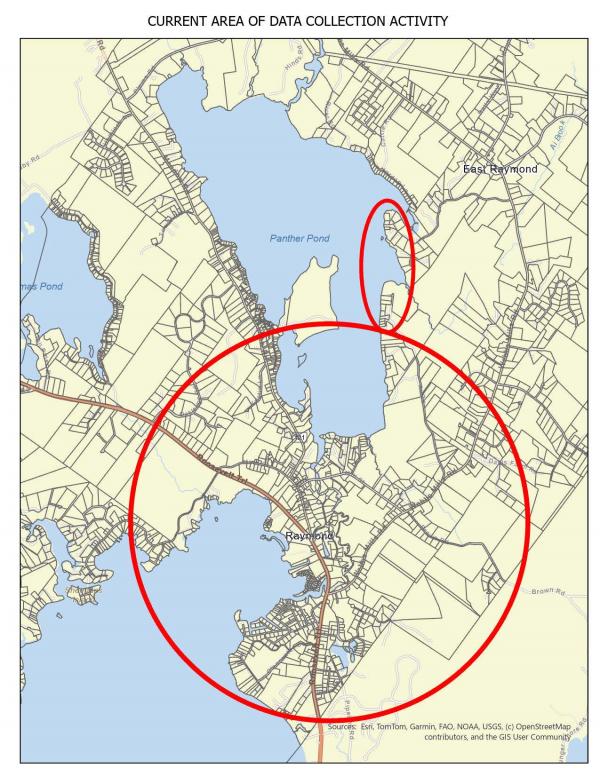

Our townwide Revaluation is underway. It starts now and will conclude in the summer of 2026. We have contracted KRT Appraisal of Haverhill, MA, to complete the project.

The Revaluation begins with KRT’s Data Collectors visiting every property in Raymond.

If you have any doubts at all about these visitors asking to see your property, the KRT personnel will be carrying a letter of introduction from me and the town manager. They’ll have Assessing Office signs on their vehicles and KRT credentials on their person. Follow the link at the bottom of this page to view photo ID's of the KRT data collection staff currently working in the area. If in doubt call my office to verify at 655-4742 or the Police Department at 1-800-266-1444.

Their job is to measure every building on every property and to perform a quick inspection of the interiors. In this way, you and we are assured the information used to value your property is accurate. You do not have to allow them on your property, but the information they are gathering and verifying makes an accurate assessment much more likely.

KRT will be sending postcards out in batches. Once you receive a postcard you can expect a visit within the next 60 days.

I thank you in advance for your cooperation.

Curt Lebel, CMA

AT THIS TIME, THE ASSESSING OFFICE IS NOT PRE-SCHEDULING APPOINTMENTS FOR A REVAL APPRAISAL. IN ORDER TO STAY ON SCHEDULE, KRT IS WORKING DOOR TO DOOR FROM STREET SHEETS ONLY. IF THE PROPERTY OWNER IS UNAVAILABLE A LETTER WILL BE MAILED TO THE OWNER NEAR THE END OF THE COLLECTION PHASE REQUESTING THAT AN APPOINTMENT BE SCHEDULED FOR AN INTERIOR INSPECTION.

A list of current streets they will be collecting data from can be found on their website along with additional information on the revaluation process at KRT's Website.

UPDATED: 07/09/2025

|

|

|

RFP for ROADWAY RECLAMATION AND HOT MIX ASPHALT PAVEMENT

The Town of Raymond is soliciting sealed competitive bids for Roadway Reclamation Services and Hot Mix Asphalt Pavement for road improvement projects for Viola, Pine, Tower, Martin Heights, and Lloyd's Lane areas.

SUBMISSION OF BIDS

Bids must be submitted on the BID SHEET and MAILED or DELIVERED BY HAND on or before July 9th, 2025, by 2pm to the Town Office, 401 Webbs Mills Rd, Raymond, ME 04070. Envelope should be marked with “SEALED BID - PAVING”.

Bid opening will take place at the Town of Raymond - Broadcast Studio at 423 Webbs Mills Rd, Raymond - July 9th at 2pm.

RFP Document and Bid Sheets: CLICK HERE

Looking for a way to get to know how Raymond works and give back to the community? Here is your opportunity! We are looking for individuals who would be interested in serving on the following committees:

Planning Board

Board of Assessment Review

Please click HERE for more information.

RFP for ROADWAY RECLAMATION AND HOT MIX ASPHALT PAVEMENT

The Town of Raymond is soliciting sealed competitive bids for Roadway Reclamation Services and Hot Mix Asphalt Pavement for road improvement projects for Viola, Pine, Tower, Martin Heights, and Lloyd's Lane areas.

SUBMISSION OF BIDS

Bids must be submitted on the BID SHEET and MAILED or DELIVERED BY HAND on or before July 9th, 2025, by 2pm to the Town Office, 401 Webbs Mills Rd, Raymond, ME 04070. Envelope should be marked with “SEALED BID - PAVING”.

Bid opening will take place at the Town of Raymond - Broadcast Studio at 423 Webbs Mills Rd, Raymond - July 9th at 2pm.

RFP Document and Bid Sheets: CLICK HERE